How to Structure Your Business and the Key Tax Obligations

We understand that how you structure your business can be a complex decision with the pressure to get the foundations right.

Our Strategem Accountants are highly experienced in working with professionals and business owners, ensuring you understand the differences between business structures and our expertise can help provide advice on which structure will work for your individual needs.

Types of business structures

A business structure:

defines who owns and operates a business

affects your tax and registration requirements

affects your legal liabilities and obligations.

There are 4 commonly used business structures in Australia:

Sole Trader

Partnership

Company

Trust.

DISCLAIMER: The information provided below is a direct reference to the ATO and Business.gov, our Strategem team has provided you with an up to date record and understanding of business structures and key tax obligations as of 24 January 2024.

1. Sole trader

A sole trader is an individual running a business. It is the simplest and cheapest way to run a business.

If you run your business as a sole trader, you are:

the sole owner and controller of it

legally responsible for all aspects of the business, including debts and losses you incur in running it.

You can employ workers in your business, but you cannot employ yourself.

As a sole trader, you are responsible for paying your worker’s superannuation, known as super guarantee. You don't have to pay super guarantee for yourself but you can choose to make personal super contributions to save for your retirement.

Key Tax Obligations

As a sole trader, you:

use your individual tax file number (TFN) when lodging your tax return

report all your income in your individual tax return, using the section for business items to show your business income and expenses (there is no separate business tax return for sole traders)

are entitled to an Australian business number (ABN) and use that ABN for all business activities

must register for goods and services tax (GST) if

your annual GST turnover is $75,000 or more

you provide taxi, limousine or ride-sourcing services (regardless of your GST turnover)

you want to claim fuel tax credits

may be required to lodge business activity statements, for example if you are registered for GST, have employer obligations such as PAYG withholding, or have PAYG instalments

pay tax on all your income, including income from your business, based on your individual tax rate

may voluntarily use, or be required to make, PAYG instalments to prepay your income tax

can claim a deduction for any personal super contributions you make after notifying your fund

can hire workers, and need to meet all employer and super obligations for them.

As a sole trader, you can claim a deduction for salary, wages and allowances you pay your workers on your tax return.

You cannot claim a deduction for money or assets you take from the business for personal use.

2. Partnership

A partnership is a group or association of people who run a business together and share the income or losses from the business between themselves.

A written partnership agreement is not required for a partnership to exist but can help:

prevent misunderstandings and disputes about what each partner brings to the partnership

set out how business income and losses are to be shared between the partners (equally between partners or not)

set out how the business is to be managed.

If there is no written agreement, income and losses are equally distributed between partners.

The partners in a partnership are not employees of the partnership, but they are able to employ other workers.

Partners are responsible for their own superannuation. However, the partnership is required to pay super for its employees.

Key Tax Obligations

A partnership:

has its own TFN

must lodge an annual partnership return showing all business income and deductions and how its income or losses are distributed to the partners

must apply for an ABNExternal Link and use it for all business activities

must register for GST if it

has annual GST turnover of $75,000 ($150,000 for not-for-profit organisations) or more

provides taxi, limousine or ride-sourcing services (regardless of GST turnover)

wants to claim fuel tax credits

may be required to lodge business activity statements, for example if it is registered for GST, has employer obligations such as pay as you go withholding, or have pay as you go instalments

does not pay tax

each partner reports their share of the net partnership income or loss in their own tax return and is personally liable for any tax that may be due on that income.

A partnership and its partners cannot claim a deduction for money they withdraw from the business. Amounts you take from a partnership:

are not wages for tax purposes

may affect what your share of the partnership income is that you have to pay tax on.

You will need to be aware of the steps to take if you change the makeup of your partnership.

3. Company

A company is a separate legal entity with its own tax and superannuation obligations, run by its directors and owned by its shareholders.

A company's income and assets belong to it, not its shareholders. There may be tax consequences if you are using your company's money and assets for private purposes.

A company can distribute profits to its shareholders through dividends and may be able to attach franking credits to those dividends. This allows its shareholders to receive a credit for the tax already paid by the company on its profits.

While a company provides some asset protection, its directors can be liable for their actions and, in some cases, certain tax and superannuation debts of the company under the director penalties rules.

All company directors are legally required to verify their identity and apply for a director identification number (director ID) prior to being appointed as a director of a company.

Companies are regulated by the Australian Securities and Investments Commission (ASIC).

Companies have higher set-up and administration costs than other types of business structures and have additional reporting requirements.

Key Tax Obligations

A company:

is responsible for its own tax and superannuation obligations

must apply for its own TFN

is entitled to an ABN if it is registered under the Corporations Act 2001

if the company is not registered under the Corporations Act 2001 it may still register for an ABN if it is running a business in Australia

must register for GST if it

has annual GST turnover of $75,000 ($150,000 for not-for-profit organisations) or more

provides taxi, limousine or ride-sourcing services (regardless of GST turnover)

wants to claim fuel tax credits

may be required to lodge business activity statements, for example if it is registered for GST, has employer obligations such as PAYG withholding, or has PAYG instalments

owns the money that the business earns (you may have to pay tax on any money taken out for personal use)

must lodge an annual company tax return

usually pays its income tax by instalments through the pay as you go instalments system

pays tax at its applicable company tax rate

must pay super guarantee for any eligible workers (this includes any company directors)

must issue distribution statements to any shareholders it pays a dividend to.

There is information you need to know if your company will be deregistered.

4. Trust

A trust is an obligation imposed on a person or other entity to hold and manage property for the benefit of beneficiaries. If a trust is set up to run a business, it will normally have a trust deed that, among other things, sets out the powers of the trustees and the interests of the beneficiaries in the trust.

The trustee manages a trust's tax affairs. The trustee can be an individual or a company. The net income of the trust is usually distributed to beneficiaries.

Key Tax Obligations

A trust:

must have its own TFN

must lodge an annual trust tax return, which includes a statement of how its income was distributed

must apply for an ABNExternal Link and use it for all business activities

must register for GST if it

has annual GST turnover of $75,000 ($150,000 for not-for-profit organisations) or more

provides taxi, limousine or ride-sourcing services (regardless of GST turnover)

want to claim fuel tax credits

may be required to lodge business activity statements, for example if it is registered for GST, has employer obligations such as pay as you go withholding, or has pay as you go instalments

must pay super for eligible employees (this may include the trustee if employed by the trust).

Who pays income tax?

The trustee must lodge an annual trust tax return. Who pays tax on the trust’s income is determined by how the trust income is distributed and who it is distributed to.

Generally, the beneficiaries will be responsible for paying tax on the trust net income distributed to them.

The trustee is liable to pay tax on any undistributed income and may be liable to pay tax on behalf of certain beneficiaries, like non-residents or minors.

There may be other circumstances where the trustee is responsible for paying tax.

If the trust makes a loss, it cannot be distributed to the beneficiaries and they cannot claim it as a loss against their income.

However, the trust may be able to carry forward losses and offset them against future income it earns.

How to choose a business structure

Selecting the right business structure is crucial for meeting your unique business needs. Take your time to evaluate each option, considering the specific factors and regulations associated with each structure.

Your chosen business structure can impact various aspects, including:

The licenses necessary for operation

Tax obligations

Your legal status as an employee or business owner

Personal liability

Level of control over business operations

Administrative requirements and paperwork volume

Keep in mind that you have the flexibility to change your business structure as your enterprise evolves. As your business grows, you may find it beneficial to transition to a different structure better suited to your expanding needs and aspirations.

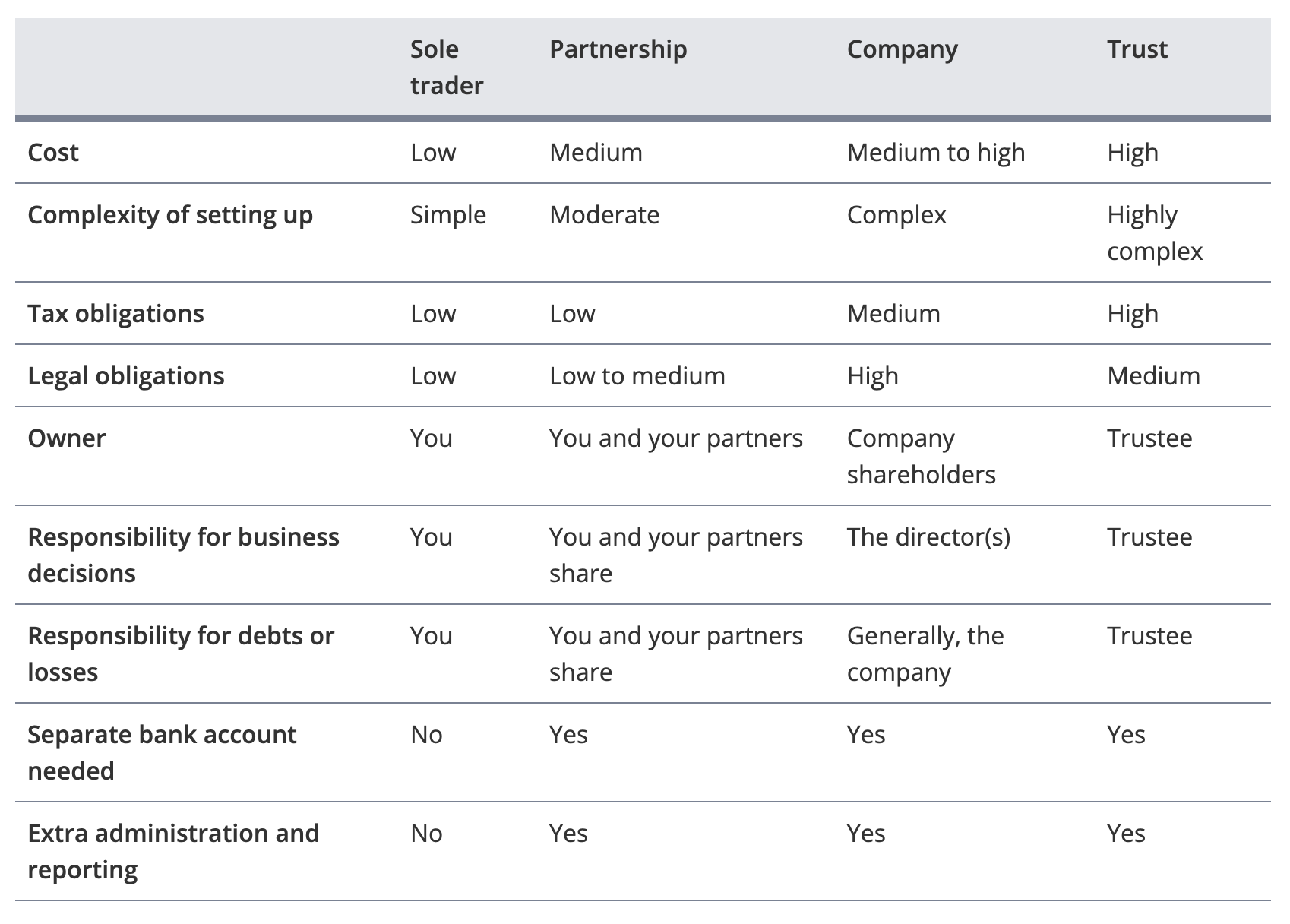

Key differences between business structures

Still unsure which to choose?

If you're unsure which business structure to choose, talk to your Strategem Accountant or Advisor.

Also, if you change your business structure, there may be costs, tax implications and other obligations you need to meet. Don’t hesitate to get in touch.

We are here to help

If you need further advice on this topic, please do not hesitate to contact our office on (03) 5445 4777 and one of our Accountants or Advisors will be available to support you.