The Benefits of Working with an Insurance Specialist

Insurance is more than just a policy—it’s peace of mind. Yet, many Australians remain underinsured or unsure whether their cover truly protects them. With life’s uncertainties, the difference between being properly protected and being left vulnerable often comes down to the guidance of an insurance specialist.

At Strategem Financial Services, we believe tailored advice makes all the difference. Here’s why working with an insurance specialist is one of the most important steps you can take for your financial well-being.

1. Personalised Cover That Matches Your Needs

Life insurance isn’t one-size-fits-all. Your needs will differ depending on whether you’re:

A young professional with debts but no dependents

A family with children and a mortgage

A business owner with staff relying on you

Someone preparing for retirement

An insurance specialist works through your personal circumstances—debts, income, lifestyle, and goals—to ensure your cover is fit for purpose. This prevents both underinsurance (leaving you exposed) and overinsurance (paying for unnecessary cover).

2. Clarity in a Complex Market

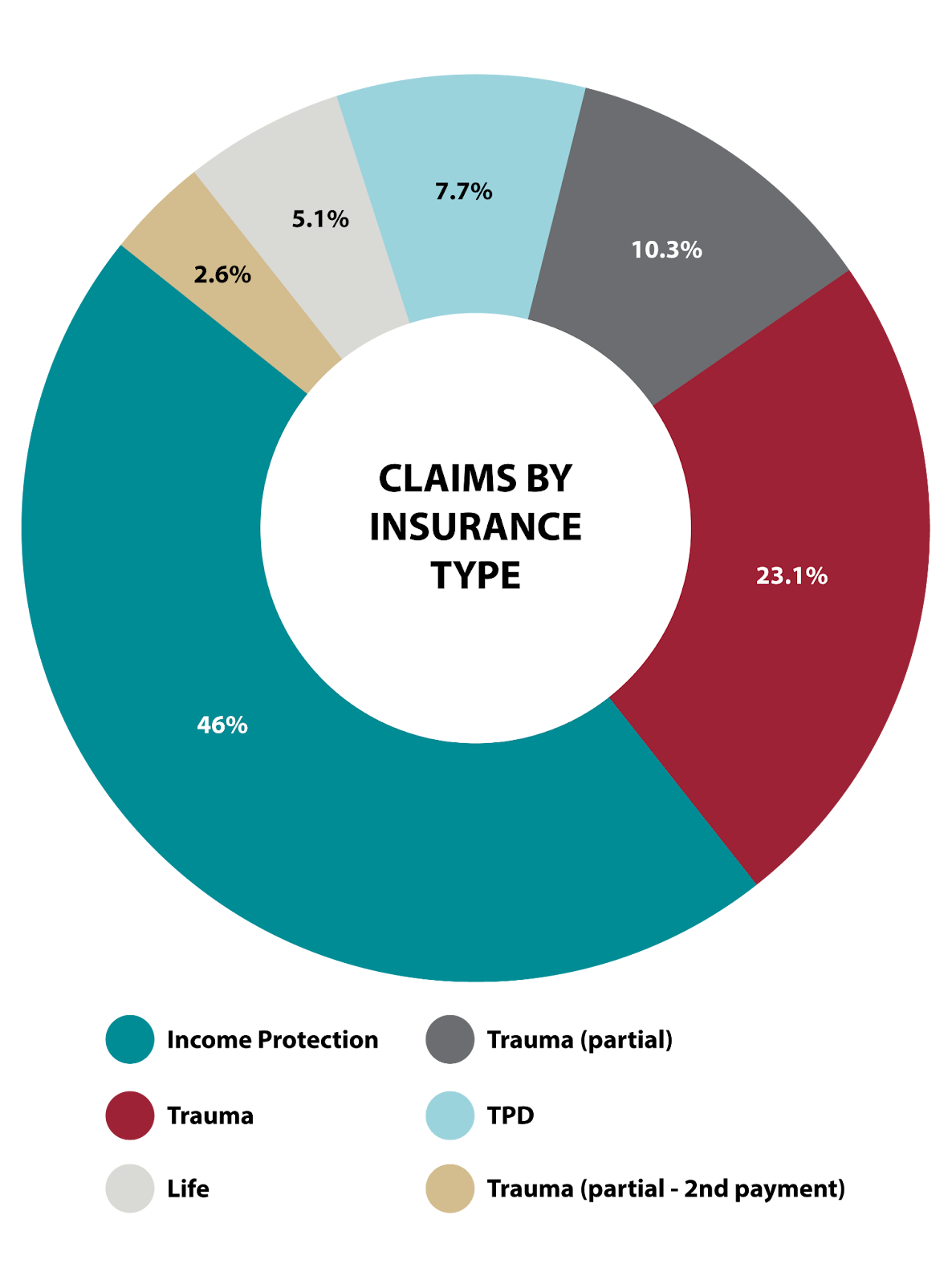

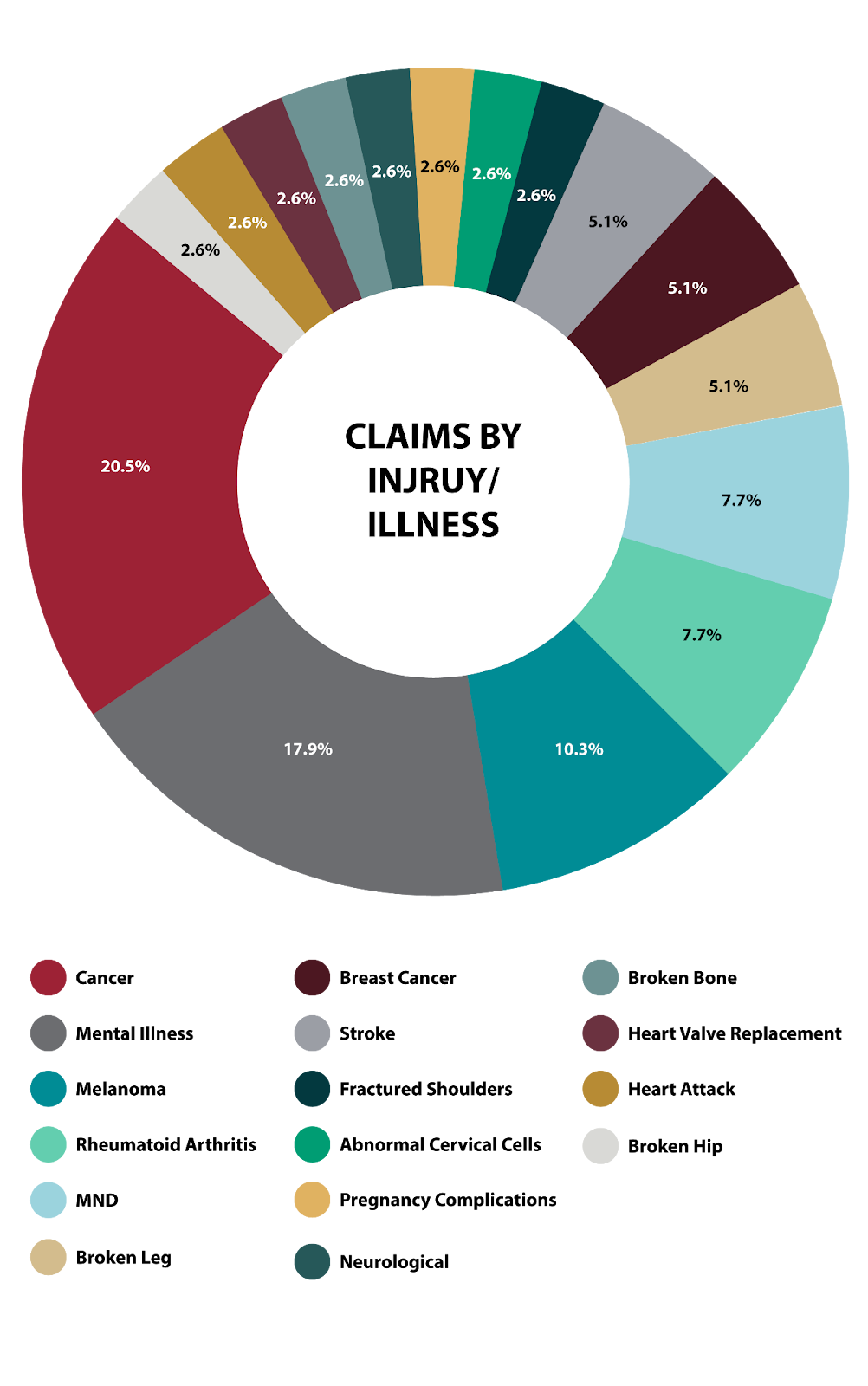

From Life Cover and TPD, to Trauma and Income Protection, the insurance landscape is complex. Each policy comes with fine print, exclusions, and tricky definitions. Specialists help you:

Understand what’s really covered

Identify hidden gaps

Compare providers and products fairly

This guidance is particularly valuable given recent industry statistics showing that many Australians mistakenly believe their default cover through superannuation is “enough”—when in reality, it often falls well short of actual needs.

3. Higher Confidence at Claim Time

Perhaps the greatest value an insurance specialist provides is during the claims process. At a time when emotions run high, having an expert advocate to:

Navigate paperwork

Liaise directly with insurers

Push back against unfair delays or assessments

…can make the process smoother and ensure you receive what you’re entitled to.

4. Strategic, Cost-Effective Solutions

Insurance isn’t about finding the cheapest premium—it’s about finding the right balance of cost and protection. Specialists can:

Structure policies inside or outside of super for tax efficiency

Recommend stepped vs level premiums depending on your goals

Consolidate overlapping cover to reduce wasted spend

This means your premiums work harder for you without leaving you exposed.

5. Ongoing Partnership Through Life’s Changes

Marriage, children, a new business, or approaching retirement—life doesn’t stand still, and neither should your insurance. An insurance specialist builds a long-term relationship with you, ensuring your cover adapts as your needs evolve.

Insurance is about protecting what matters most—your family, your income, your future. By working with a trusted insurance specialist, you’re not just buying a policy, you’re gaining a partner who will guide you through complexity, stand by you at claim time, and keep your cover relevant throughout your life.

At Strategem Financial Services, our insurance specialists combine technical expertise with genuine care. We help you protect today and prepare for tomorrow—with confidence.

📞 Contact our team today to arrange a review of your cover.

We are here to help

If you need further advice, please do not hesitate to contact our office on (03) 5445 4777 and one of our Accountants & Advisors are available to support you.

Contact Us

If you have any concerns about investment scams or would like to learn more about protecting your wealth, book a chat with one of our financial experts today.