June 2025 Tax Update | What You Need to Know Before EOFY

As the financial year draws to a close, businesses have only days left to take advantage of tax-time opportunities. Whether you're a seasoned operator or simply trying to stay compliant, now is the time to make strategic decisions that can reduce your tax liability and set you up for a stronger 2024/25.

From bringing forward expenses to locking in deductions you may have overlooked, these last-minute strategies can help you finish the year with confidence—and potentially some savings. Here’s what to review before the clock strikes midnight on June 30.

What’s New from the ATO?

ATO Cracks Down on Wild Deduction Claims

Every year, the ATO reminds taxpayers to keep it ‘real’—and this year is no exception. They've flagged some outrageous work-related expense claims that don’t apply:

✔ A mechanic tried to claim a TV, gaming console, and two vacuum cleaners.

✔ A truck driver tried to deduct swimwear.

✔ A fashion industry manager claimed over $10,000 in luxury clothes.

Moral of the story: Personal items are not deductible, even if you wear or use them while working.

EOFY Tax Planning

For Individuals

Now’s the time to maximise your deductions. Here's a checklist of strategies to consider before 1 July 2025:

Common Deductible Purchases:

Tools of trade, software, and books (if under $300 each).

Uniforms and protective clothing (and laundry costs).

Self-education costs (like course fees and textbooks).

Union fees, insurance premiums (excluding TPD), and subscriptions.

Tip:

If your income is lower than usual this year, consider deferring some deductions. Otherwise, prepay them before EOFY to reduce your tax bill.

For Businesses

Strategic Moves for 2024/25

$20,000 Instant Asset Write-off

Good news for small businesses—if your annual turnover is under $10 million, the $20,000 instant asset write-off is still in play for eligible new or second-hand assets. To claim the deduction, assets must be first used or installed and ready for use by 30 June 2025.

This is a valuable way to bring forward deductions—especially if you’re planning to upgrade tech, vehicles, or business equipment in the near future.

Other Smart Strategies to Action Now

The following tax-time tactics can help bring forward deductions into the 2023/24 year:

Prepay upcoming expenses such as rent, interest on loans, or business subscriptions (must cover a period of 12 months or less).

Accelerate planned costs like office repairs, advertising campaigns, or consumables—if you’ll need it soon, now’s the time to act.

Make employee superannuation contributions by 30 June to ensure they’re deductible this financial year. Payment must clear by EOFY, not just be processed.

Review your debtors and write off any bad debts to claim a deduction.

Complete stocktakes and consider writing down obsolete or slow-moving stock.

Accrual-based Deductions You Might Be Missing

Even if the cash hasn’t left your account yet, you may still be eligible to claim certain accrued expenses in 2023/24:

Staff wages or bonuses earned before 30 June but paid afterward.

Interest accrued on business loans, even if not yet paid.

Director fees that are properly documented and committed to before EOFY.

The key here is that the expense must be incurred, not necessarily paid—so proper documentation is essential.

Maximise Super Contributions (and Avoid the Cap Trap)

Concessional (pre-tax) super contributions are capped at $27,500 for the 2023/24 year. If you haven’t maxed it out yet—and have the capacity—topping up can reduce your taxable income and build wealth.

Tip: If you haven’t used your full cap in previous years and your total super balance is under $500,000, you may be eligible for carry-forward contributions using unused caps from the past five years.

Defer Income (If Cash Flow Allows)

If your income for this year is unusually high and you expect to be in a lower tax bracket next year:

Delay issuing invoices until 1 July.

Consider deferring investment income or asset sales.

This strategy is especially effective for cash-based businesses or sole traders with flexible timing options.

Review Trust Distributions

If you operate through a discretionary trust, make sure your trust distribution resolutions are finalised by 30 June. Delaying this can result in default tax at the top marginal rate.

Review the most tax-effective way to distribute income across adult beneficiaries, corporate beneficiaries, or even bucket companies.

Use a Bucket Company

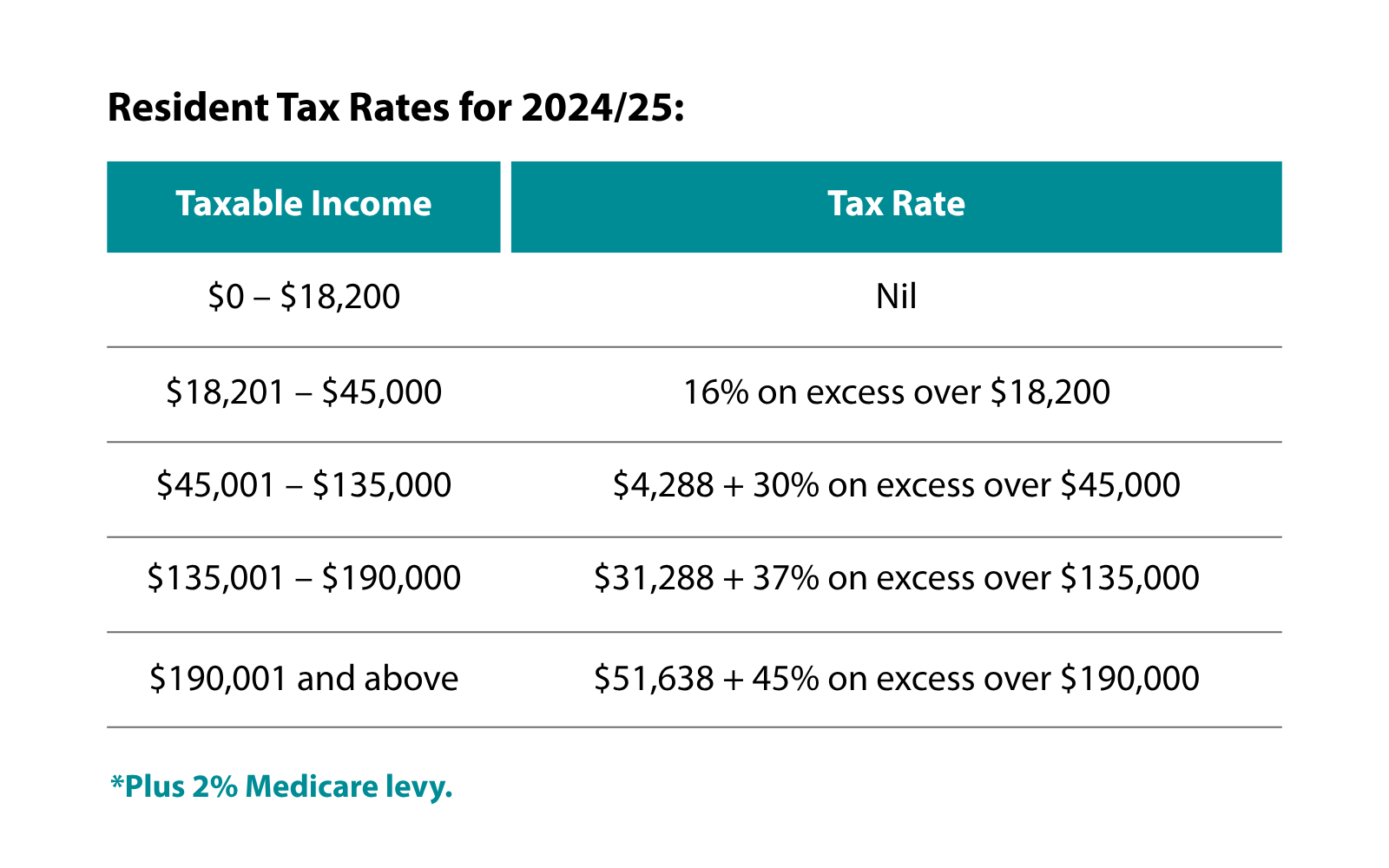

High-income earners using a family trust may benefit from directing some income to a bucket company. This allows income to be taxed at the company rate (25–30%) instead of individual rates that can reach 47%.

The company retains funds, which can be used later for investments or business purposes—though there are rules about how and when funds can be accessed. Talk to our advisors about if this is an option for you now or in the future.

Make Donations to Reduce Tax

Charitable giving to Deductible Gift Recipients (DGRs) can reduce taxable income—perfect for HNWIs with philanthropic goals.

Ensure donations are made and receipted before 30 June to be deductible in this financial year.

Capital Gains Tax (CGT) Review

If you’ve sold assets this year:

Offset capital gains by selling underperforming investments (crystallising a capital loss).

Review the timing of any planned disposals to manage CGT impact.

For small business owners, explore the small business CGT concessions, which can offer major tax savings when selling business assets.

Dealing with Tax Debt? Relief May Be Available

In a recent ruling, the Administrative Review Tribunal (ART) granted partial debt relief to a taxpayer suffering serious hardship—even though he owed over $500,000. If you’re experiencing hardship, speak to us about your options.

Starting a Business This NFY? Here’s What to Know

Whether you’re new to business or about to start your 2nd or 3rd, you should:

✔ Use digital tools to manage finances and stay compliant.

✔ Register for an ABN and business name.

✔ Keep accurate records and only claim business-related costs.

✔ Understand your tax structure and employer responsibilities.

Need help setting up correctly from day one? Get in touch with our advisors or accountants today.

Your EOFY Checklist

Whether you're a wage earner or running a company, make sure you:

✔️ Gather receipts and logbooks.

✔️ Finalise asset purchases.

✔️ Assess super contributions.

✔️ Write off bad debts.

✔️ Book your tax planning meeting for next year early.

Let's Talk

Tax time doesn’t have to be stressful. Contact Strategem Financial Services to:

Maximise your deductions

Avoid ATO red flags

Make the most of business concessions

Call us today or book an appointment online. EOFY is closer than you think!

We are here to help

If you need further advice, please do not hesitate to contact our office on (03) 5445 4777 and one of our Accountants & Advisors are available to support you.

Contact Us

Book a consultation with our Strategem team today and let’s make sure your business is FBT-ready before the deadline!